By Asif Charania, CPA/ABV/CFF, ASA, Partner, Valuation & Forensic Practice Leader

A transaction involving the sale of a company with appreciated assets can result in a significant tax liability for the seller. However, through proper tax planning and the right facts and circumstances, the potential tax liability can be significantly reduced by allocating a portion of the fair market value of the company to the personal goodwill of the seller, which is actually a personal asset of the seller. Accordingly, a transaction involving the transfer of personal goodwill to a prospective buyer will result in capital gains treatment to the seller, rather than double taxation at the entity and shareholder levels attributable to C corporations and certain S corporations. This article will introduce the concept of personal goodwill from a transaction perspective and discuss the necessary factors required to support an allocation of the purchase price to personal goodwill of the seller.

Asset Sale v. Stock Sale

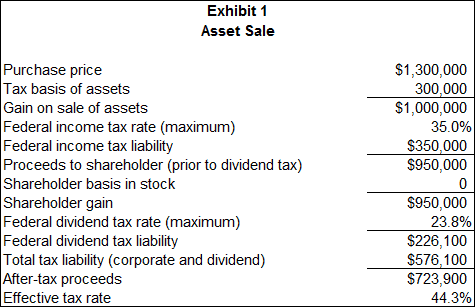

The sale of assets held in a C corporation, an S corporation with earnings and profits, or an S corporation subject to the built-in gains tax can result in a tax liability at the corporate and shareholder levels.1

This double taxation can be avoided if the transaction is structured as a stock deal, where the buyer will only be subject to a capital gains tax (see Exhibit 2). However, a buyer will most likely require the transaction to be structured as an asset sale (or a stock sale with a 338(h)(10) election) as the buyer’s basis in the assets would be stepped-up to fair market value. In addition, an asset deal will allow the buyer to choose the assets and liabilities they want to purchase and/or assume.2

Assuming an asset sale, the buyer and seller are required to allocate the purchase price to the assets acquired and sold at their fair market values for income tax reporting purposes. Typical assets include net working capital, fixed assets, identifiable intangible assets, and goodwill (see Exhibit 3, left side of economic balance sheet).

Exhibit 3

The value of identifiable intangible assets must be recognized apart from unidentifiable intangible assets (i.e. goodwill) if the assets arise from contractual or other legal rights or if the assets are separable from the business and can be sold, transferred, etc. Examples of potential intangible assets to be considered include the following:

-

- Marketing-related – Trademarks, trade names, non-competition agreements

- Customer-related – Customer lists

- Artistic-related – Plays, operas and ballets

- Contract-based – Licensing, royalty agreements, employment contracts

- Technology-based – Patented technology, computer software, trade secrets3

Goodwill

The excess of the value over the amounts allocated to tangible and identifiable intangible assets is recognized as goodwill. Goodwill is defined in Treas. Reg. § 1.197-2(b) (1) as follows:

Goodwill is the value of a trade or business attributable to the expectancy of continued customer patronage. This expectancy may be due to the name or reputation of a trade or business or any other factor.4

IRS Rev. Rul. 59-60 further defines goodwill as follows:

In the final analysis, goodwill is based upon earning capacity. The presence of goodwill and its value, therefore, rests upon the excess of net earnings over and above a fair return on the net tangible assets. While the element of goodwill may be based primarily on earnings, such factors as the prestige and renown of the business, the ownership of a trade or brand name, and a record of successful operation over a prolonged period in a particular locality, also may furnish support for the inclusion of intangible value.5

As noted in Exhibit 3, goodwill can be further bifurcated into two components: personal goodwill and entity goodwill. Personal goodwill exists when the shareholder’s reputation and expertise contributes to the appreciation of the business’s value since its inception. In addition, this asset belongs to the shareholder and not the target company. Characteristics that support the existence of personal versus entity goodwill are as follows:

Entity Goodwill

- Shareholder is passive with respect to the operations of the business

- Loss of shareholder would not materially impact the operations of the business

- Non-compete agreement/employment agreement exists for key shareholder of the business

- Strong depth of management and formal organizational structures

- Existence of brand recognition

- Diverse customer base

- Asset intensive business

- Lack of competition

- Market share maintained through patents or other know-how

Personal Goodwill

- Shareholder is actively involved in the business

- Loss of shareholder would materially impact the operations of the business

- Existence of non-compete/employment agreement for shareholder

- Existence of key man life insurance policies

- Shareholder possesses primary relationships with customers and is the primary “rain maker” in the business

- Customer base is small and concentrated

- Lack of contracts with customers or contracts that are terminable at will

- Business is highly technical or a professional service

- Company maintains market share despite significant competition

The existence of a non-compete and employment agreements significantly impacts the distinction between personal and entity goodwill. Typically, agreements that exist prior to a transaction have the impact of transferring personal goodwill to the entity. However, agreements entered into during the transaction process support the allocation to personal goodwill.

The implications of such agreements on the determination of personal or practice goodwill is discussed in two landmark Tax Court cases. In Martin Ice Cream Co. v. Commissioner, the Tax Court ruled:

This Court has long recognized that personal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation. Those personal assets are entirely distinct from the intangible corporate asset of corporate goodwill.6

Further, in William Norwalk, et al, v. Commissioner, the Tax Court stated:

We have held that there is no salable goodwill where, as here, the business of a corporation is dependent upon its key employees, unless they enter into a covenant not to compete with the corporation or other agreement whereby their personal relationships with clients become property of the corporation.7

As previously noted, proper planning is critical when making a case for allocating value to personal goodwill. The company and its advisors need to carefully review all documents and historical transactions to make sure personal goodwill was not transferred to the entity through other means. For example, if the business converted from a sole proprietorship to a corporation and assets were transferred via a blanket bill of sale, then technically personal goodwill was transferred during the incorporation process.

Sale of Personal Goodwill in Conjunction with Sale of Corporate Assets

Given that personal goodwill is an asset of the seller, two separate transactions should be executed when consummating a transaction: 1) the sale of corporate assets and 2) the sale of personal goodwill of the selling shareholder. In addition, any personal goodwill must be both salable and transferable. Accordingly, a seller should enter in a covenant not to compete with the buyer simultaneously during the sale of corporate assets, which serves to transfer the seller’s personal goodwill to the buyer. In addition, the proceeds from the sale of personal goodwill is taxed at the favorable capital gains rate rather than treated as ordinary income to the seller.

Case Study

The following case study discusses a hypothetical sale of a dermatology practice to an industry consolidator, and demonstrates how to allocate a portion of the purchase price to personal goodwill of the seller.

Dr. Jones owns 100% of the equity of Jones Skin Care (the “Practice”), which is located in a densely populated suburb outside of Washington, D.C. The Practice also employs a physician extender, a nurse, two medical assistants, and three office staff. Dr. Jones has received several accolades from top medical publications for her specialization in complex skin care issues, and is recognized as one of the top 10 dermatologists in the Washington, D.C. metro area. Because of her expertise, Dr. Jones receives several referrals from general practitioners and other dermatologists. Based upon an analysis of the Practice’s billing system and discussions with office staff, over 90% of all patients were referred from other physicians.

The Practice is exposed to significant competition as there are 30 other dermatologist practices located within 10 miles of the Practice. Nevertheless, the Practice has been able to maintain market share because of Dr. Jones’ reputation and expertise. However, Dr. Jones has been limited on the number of patients she can see on a given day, especially since her encounters with patients with complex skin conditions have increased significantly over the years. Consequently, Dr. Jones hired Ms. Smith, a nurse practitioner, to see patients with less complex conditions.

On December 31, 2015, an industry consolidator approached Dr. Jones with an offer to acquire the Practice. An independent business appraiser was retained and determined that the fair market value of the Practice’s assets was $1.3 million. The fair market value of the practice’s tangible assets and intangible assets were as follows:

- Net working capital – $200,000

- Fixed assets – $300,000

- Assembled workforce – $100,000

- Goodwill (entity and personal) – $700,000

The business appraiser was also retained to determine if any portion of the residual goodwill could be further bifurcated between entity and personal goodwill. The business appraiser analyzed the following factors:8

| · Age and health of practitioner | · Location and competition |

| · Areas of specialization | · Patient base and visits |

| · Ancillary services | · Referral base |

| · Cash flow/earnings ability | · Equipment owned |

| · Prior changes in ownership | · Works habits/schedule |

Based upon consideration of the aforementioned factors above and that fact that a majority of referrals to the Practice were from other physicians who referred patients directly to the Dr. Jones because of her expertise, the appraiser estimated that approximately 90% of the total goodwill is the personal goodwill of Dr. Jones and the remaining 10% of total goodwill is practice goodwill. The appraiser believed that some entity goodwill exists because the Practice was able to utilize a physician extender to assist Dr. Jones in seeing patients.

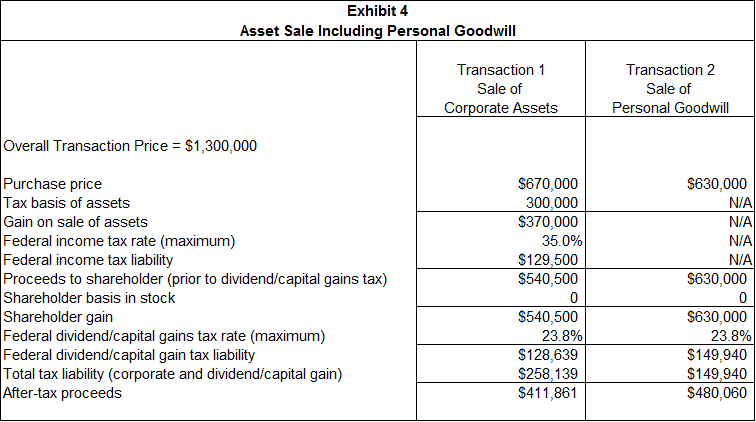

Dr. Jones’ attorneys and advisers executed two separate transactions: 1) an asset purchase of the corporate assets and 2) a separate sale of Dr. Jones’ personal goodwill which will be transferred when Dr. Jones executes a covenant non to compete with the buyer. A summary of these transactions are as follows:

As the appraiser was able to allocate a portion of the fair market value of the assets to personal goodwill of Dr. Jones, the effective tax rate of the transaction was as follows:

Exhibit 5

As noted in Exhibit 1, if the asset purchase was consummated without the consideration of personal goodwill, the effective tax rate of the transaction would have been 44.3%. However, as the appraiser was able to establish that personal goodwill existed, Dr. Jones’ attorneys and advisers were able to structure the transaction in Exhibit 4, which resulted in an effective tax rate of 31%. The overall tax savings were as follows:

Exhibit 6

Need assistance allocating a portion of the fair market value of the company to the personal goodwill of the seller? Keiter can help. We can put you in touch with the resources you need to reach your business goals. 804.747.0000 | Email us.

References

- Payne, Jackson M. “Goodwill as Part of a Corporate Asset Sale,” The Tax Advisor, 2014, www.aicpa.org/publications/taxadviser/2014/may/pages/payne_may2014.aspx?action=print, (accessed April 1, 2016), 1.

- Risius, Jeffrey M. and Aaron M. Stumpf. “The Use of Personal Goodwill as a Tax Savings Opportunity in a Transaction: Recent Case Law Highlights the Importance of Good Facts and Economic Support.” SRR Journal. Chicago, IL: Stout Risius Ross, 2011.

- Financial Accounting Standards Board Accounting Standards Codification 805-20–55, Business Combinations (as amended) (Norwalk, CT: Financial Accounting Standards Board, 2016).

- Treas. Reg. § 1.197-2(b) (1).

- Rev. Rul. 59-60, Sec 4.02(f).

- Martin Ice Cream Co. v. Commissioner, 110 T.C. 189 (1998).

- William Norwalk, et al, v. Commissioner, TC Memo 1998-279.

- Mark O. Dietrich, ed., The BVR / AHLA Guide to Healthcare Valuation, 3rd ed. (Portland, OR: Business Valuation Resources, LLC, 2012), 521-523.

About the Author

The information contained within this article is provided for informational purposes only and is current as of the date published. Online readers are advised not to act upon this information without seeking the service of a professional accountant, as this article is not a substitute for obtaining accounting, tax, or financial advice from a professional accountant.