By Keiter CPAs

Welcome back to Keiter’s series on ASU 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities. This article focuses on the additions of liquidity and availability disclosures to the financial statements of all not-for-profit entities.

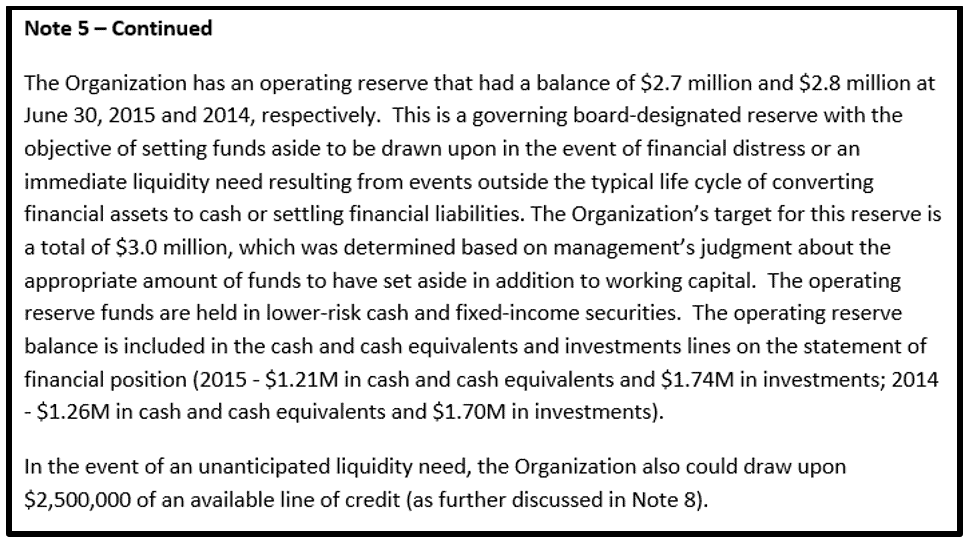

The Financial Accounting Standards Board (FASB), through the newly required disclosures over liquidity and availability, is hoping users of the financial statements will be able to better determine the financial health of an entity and identify potential solvency issues. We’ll start by identifying the newly required disclosures followed by illustrating what implementation may look like by presenting several examples.

New Liquidity and Availability Disclosures Required for Not-for-profits

First, the entity will be required to disclose certain qualitative information. This will discuss how an entity manages its liquid resources available to meet cash needs for general expenditures within one year of the Statement of Financial Position date. Second, the entity will be required to disclose certain quantitative information. This information will communicate the availability of financial assets at the balance sheet date to meet cash needs for general expenditures within one year of the Statement of Financial Position. Availability may be affected by:

- Nature of the assets;

- External limits imposed by donors, laws, and contracts with others; and

- Internal limits imposed by board decisions.

Below are a few examples detailing what the new disclosure requirements might look like in the notes to the financial statements:

Entities should start having conversations regarding these new disclosures with their boards of directors. Take the time now to calculate available financial assets and determine what story these assets tell.

Questions on this topic? Contact our your Keiter representative or our Not-for-Profit Team | Email | 804.747.0000. Stay in touch…Our next article in this series on ASU 2016-14 will cover expanded expense reporting for functional expenses and allocation methodology.

Access the ‘ASU 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities’ series:

Financial Statements of Not-For-Profits: Changes to Net Asset Classifications

Financial Statements of Not-For-Profits: Changes to Net Asset Classifications (Part II)

Functional Expense Allocation Methods Not-For-Profits Should Know (Part IV)

Not-For-Profit Functional Expense Reporting: Management and General (Part V)

Statement of Cash Flows and Investment Return Changes: Impact on Nonprofits (Part VI)

About the Author

The information contained within this article is provided for informational purposes only and is current as of the date published. Online readers are advised not to act upon this information without seeking the service of a professional accountant, as this article is not a substitute for obtaining accounting, tax, or financial advice from a professional accountant.