By Amy Rybar Menefee, CPA, CFE, Partner

Strengthen your nonprofit organization through a well-structured finance team

Mid-sized nonprofit organizations, typically operating with budgets between $5 million and $25 million, encounter a unique set of challenges. These organizations manage greater complexity than their smaller counterparts, often overseeing multiple programs, grants, and funds with donor-imposed restrictions, yet they lack the resources available to larger nonprofits. In this environment, both donors and regulators demand a high degree of transparency and timely financial reporting. Establishing a robust financial structure not only helps to mitigate risk and prevent fraud but also ensures that the organization can sustain its mission and maintain the trust of its supporters.

Team structure

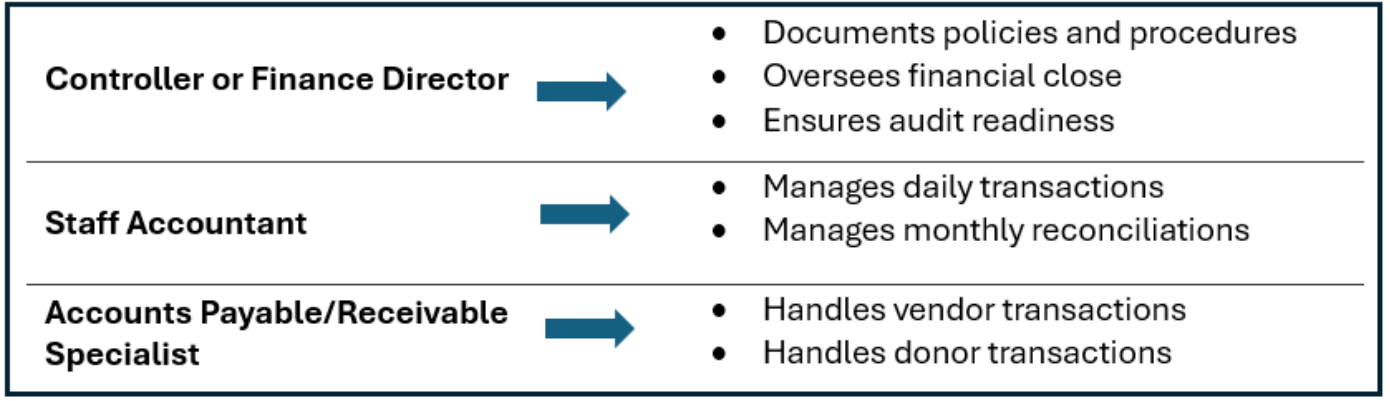

The financial team for a mid-sized nonprofit typically includes the following roles:

- Controller or finance director

- Staff accountant

- Accounts payable/receivable specialist

These core positions ensure that daily transactions, monthly reconciliations, vendor and donor transactions are managed efficiently. Depending on the organization’s needs, additional roles may also be necessary, including:

- Grant accountant

- Payroll specialist

- Financial analyst

This is especially true for organizations managing multiple grants, processing payroll in-house, or requiring detailed financial reporting.

Segregation of duties

Segregation of duties is a cornerstone of strong internal controls. By ensuring that no single person is responsible for authorizing transactions, maintaining records, and holding custody of assets, the organization reduces the risk of errors and fraud while promoting transparency and accountability.

Effective segregation of duties means distributing key financial tasks among roles such as the controller or finance director, staff accountant, and accounts payable/receivable specialist.

For example:

If key personnel, like the controller/finance director, also serve in additional capacities such as human resources, it becomes even more important for other team members to assume extra responsibilities and maintain clear boundaries to safeguard the organization’s financial integrity.

Specialized positions

In addition to core financial roles, organizations may require specialized positions to effectively manage their evolving financial landscape.

Grant Accountant

An organization may receive substantial contributions with donor restrictions and grants that mandate specific reporting requirements. This position ensures compliance with grant agreements and proper tracking of funds, which is key to maintaining donor and grantor trust.

Payroll Specialist

This role becomes indispensable for organizations handling payroll internally, ensuring accurate processing and compliance with applicable regulations.

Financial Analyst

As nonprofits experience seasonal fluctuations or expand their programs, the skills of a financial analyst may become increasingly important as they provide detailed financial reporting for funders and provide insights into the financial impact of new or growing initiatives.

Specialized skills

Each of these roles requires a distinct set of technical skills:

Proficiency in Areas Specific to Non-profit Organization

Understanding accounting principles specific to non-profit organizations, fund accounting, grant compliance, internal controls, and tax compliance forms the foundation for strong financial management for nonprofit organizations.

Analytical skills

Skills such as budget variance analysis, cash flow forecasting, and program cost allocation are equally important, enabling organizations to make informed decisions and maintain financial sustainability.

Human resource competencies

In cases where the controller or finance director also serves as the human resources director, additional competencies including conflict management, compensation design, evaluation system implementation, and knowledge of employment regulations become necessary. The ability to attract and retain mission-driven employees further strengthens the organization’s capacity to fulfill its objectives.

Employee development

Recognizing that not all skill sets may be present within the current team, organizations are encouraged to invest in training and professional development. Many technical and analytical skills can be learned, and a variety of training programs are available to develop expertise in these areas. Soft skills should not be overlooked as they are an important aspect of engaging program managers and board members. Effective communication, ethical decision-making, and the ability to educate stakeholders all help to achieve mission goals.

Certifications can also add value, signaling proficiency and commitment to best practices. Some of the credentials that help ensure staff members are equipped to meet the demands of increasingly complex financial environments include:

- Certified Public Accountant (CPA)

- Certified Nonprofit Professional (CNP) from the Nonprofit Leadership Alliance

- Graduate or executive certificates in nonprofit management offered by universities

By thoughtfully building out these roles and investing in skill development, nonprofits strengthen their financial management and enhance their capacity to achieve their mission

Questions about how to structure your nonprofit’s finance team to best support your organization’s unique needs? Reach out today for tailored guidance and solutions. Contact your Keiter Opportunity Advisor | Email

The Role of Independent Board Members in Exempt Organizations

About the Author

The information contained within this article is provided for informational purposes only and is current as of the date published. Online readers are advised not to act upon this information without seeking the service of a professional accountant, as this article is not a substitute for obtaining accounting, tax, or financial advice from a professional accountant.