By Keiter CPAs

Key takeaways from Keiter’s State and Local Tax seminar

Keiter hosted a State and Local Tax (SALT) seminar, led by our experienced tax professionals Kay Gotshall, Emma Sowers, Yuting Chen, and Katie Christopher. This seminar provided clients and attendees with insightful updates on state and local tax issues, including income apportionment, sourcing revenue, economic nexus, and telecommuting tax considerations. Below is a summary of key topics discussed at this event:

State Conformity: The “One Big Beautiful Bill Act” (OBBBA) and Virginia’s Position

State conformity refers to how states align their tax codes with federal tax law. States may adopt federal changes automatically (“rolling”), at a fixed date, or selectively.

Key Updates:

Key Updates:

- Virginia’s Approach: Virginia shifted to “rolling conformity” in 2023 but has paused adopting federal changes made in 2025–2026. This means recent federal tax law changes may not immediately impact Virginia returns.

- Other States: The map of conformity is complex—some states are “rolling,” others “fixed,” and a few have no corporate income tax at all.

- OBBBA Provisions for Entities: Includes permanent 100% bonus depreciation, Section 179 changes, and expanded deductions for research and development expenses. Interest limitation rules have also been adjusted.

- OBBBA Provisions for Individuals: Expanded itemized deductions, increased SALT cap ($40,000 in 2025, up from $10,000, with annual increases), new deductions for auto loan interest, and a senior standard deduction bonus. Notably, overtime and tips may be non-taxable, but with caps and income limits.

Practical Impact:

- For Businesses: The uncertainty around Virginia’s conformity means tax planning should be flexible. The General Assembly will address these issues in early 2026, so expect possible filing delays.

- For Individuals: Federal adjustments may not flow through to Virginia returns until legislative action. The estimated cost to Virginia for temporary personal deductions is significant, which may influence future policy decisions.

New and Revised Virginia Tax Provisions

- Pause on Rolling Conformity: Virginia will not conform to IRS amendments made between January 1, 2025, and January 1, 2027.

- Pass-Through Entity Tax (PTET): Extended through December 31, 2026.

- Tax Credits: The Qualified Equity and Subordinated Debt Investment Tax Credit and the Research and Development Tax Credit both expire January 1, 2026.

- Apportionment Changes: Virginia generally uses blended apportionment income for pass-through income for a corporate owner. Starting in 2025, a corporate owner of a non-unitary pass-through entity will allocate income at the entity level and not use the blended apportionment.

Remote Employees: Compliance and Risk

With remote and traveling employees, businesses face increased compliance and audit exposure:

- Possible Tax Requirements: Income/franchise tax, sales/use tax, local taxes, and Secretary of State registration.

- Withholding Rules: Wages are generally taxable in the state where work is performed, but exceptions exist (de minimis rules, reciprocal agreements, “convenience of employer” rule).

- Federal Legislation: The Mobile Workforce State Income Tax Act (S. 1443) would standardize withholding requirements, but as of the seminar, it is not yet law.

Action Item: Employers should review where their employees are working and ensure compliance with all applicable state and local tax rules.

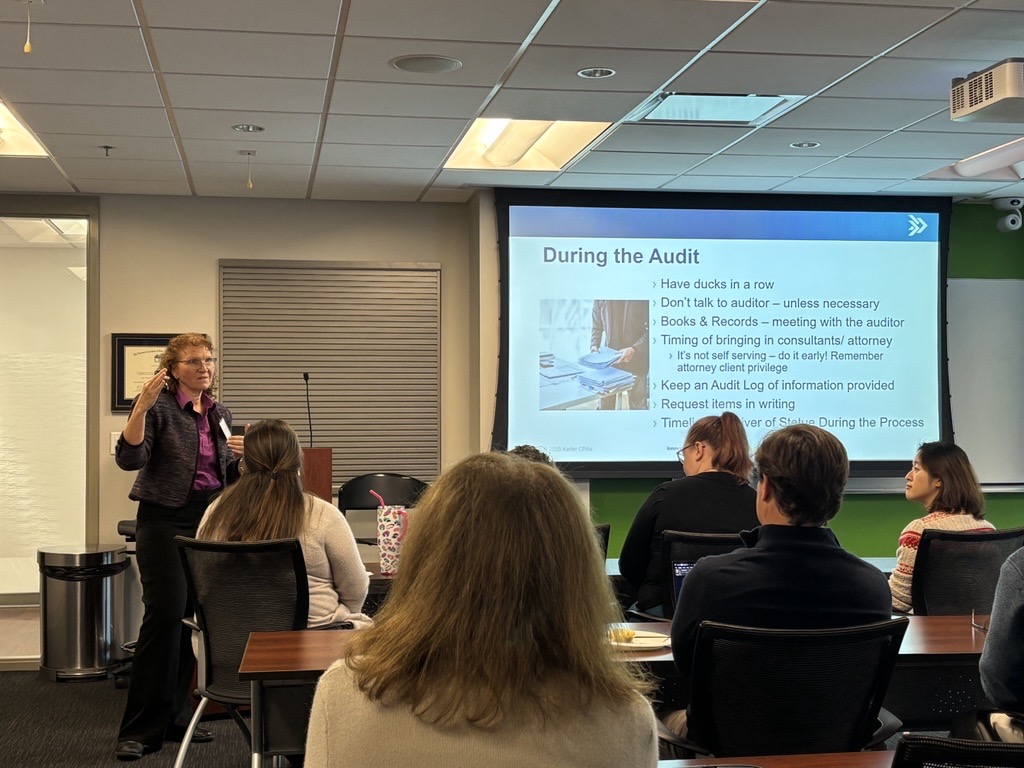

Surviving a Sales Tax Audit

Audit Triggers

- Multi-state operations, ignored notices, registration for other taxes, customer audits, fulfillment services, whistleblowers, and state information sharing.

- Filing claims for refund, industry-specific items, large deductions, prior audit results, and reporting swings.

Best Practices

- Before the Audit: Document procedures, self-audit, reconcile accounts, and retain records.

- During the Audit: Limit communication, keep an audit log, and understand sampling methods.

- After the Audit: Address findings, review audit report for correctness, consider appeals, and update procedures to ensure future compliance.

Exemptions

Understand and document all applicable sales tax exemptions by seller, buyer, property/service, intended use, or transaction type.

Key Takeaways and Next Steps

To maintain compliance, it is important to stay updated on legislative changes by regularly monitoring updates from the Virginia General Assembly and federal sources. Companies should proactively review their nexus footprint, remote employee policies, and sales tax compliance procedures. Given the complexity of state and local tax laws, seeking tailored guidance from professional advisors is recommended.

Keiter’s State and Local Tax team is here to help you navigate these challenges and identify opportunities to optimize your tax strategy. To learn more or schedule a consultation, please contact Your Keiter Opportunity Advisor or Email | 804.747.0000.

You can now watch the full recording of this seminar online.

About the Author

The information contained within this article is provided for informational purposes only and is current as of the date published. Online readers are advised not to act upon this information without seeking the service of a professional accountant, as this article is not a substitute for obtaining accounting, tax, or financial advice from a professional accountant.