By Susan Crockett, Tax Senior Associate and Ginny Graef, Tax Senior Manager | Family, Entrepreneur & Executive Advisory Services Team

Using the Updated IRS Tax Withholding Estimator (TWE)

Numerous taxpayers filed their 2018 tax returns last spring only to find themselves with an unexpectedly large tax bill when for years they had been receiving refunds. Did this happen to you? Why all of the sudden the large tax bill?

Well, the Tax Cuts & Jobs Act of 2017 enacted the biggest set of tax law changes in more than 30 years and substantially changed the way taxes are calculated for many taxpayers. However, while the method for calculating your tax liability changed, the guidelines for aiding taxpayers to determine the correct amount of tax to withhold from wages did not. Thus, many taxpayers had an unpleasant surprise last April 15th when they filed their 2018 tax returns.

To prevent this from happening again, the IRS has released a new tool on its website called the Tax Withholding Estimator (TWE). This tool assists taxpayers in determining whether a sufficient amount of federal taxes have been withheld to meet the anticipated tax liability for the current year.

The TWE asks the user a series of questions regarding sources of income, filing status, dependents, and deductions. Additionally, and most importantly, the user is able to enter information from a recent paystub so that the tool can then estimate the taxpayer’s federal tax withholdings for the whole year.

Based on inputs made by the taxpayer, the TWE estimates whether the taxpayer will owe or get a refund when the tax return is filed. If a taxpayer is anticipated to get a large refund or have a large balance due, the TWE provides the taxpayer recommendations for adjusting their Form W-4, Employee’s Withholding Allowance Certificate, to get their balance due/refund closer to zero. Remember, every employee fills out and files a Form W-4 with their payroll department. This form is what determines how much tax will be withheld from the employee’s wages. This form can be updated at any time by contacting your payroll department.

Three Shortcomings to Be Aware of Before Using

While the TWE can be very helpful, you should be aware of some of its shortcomings before using.

1. Overpayment or Underpayment

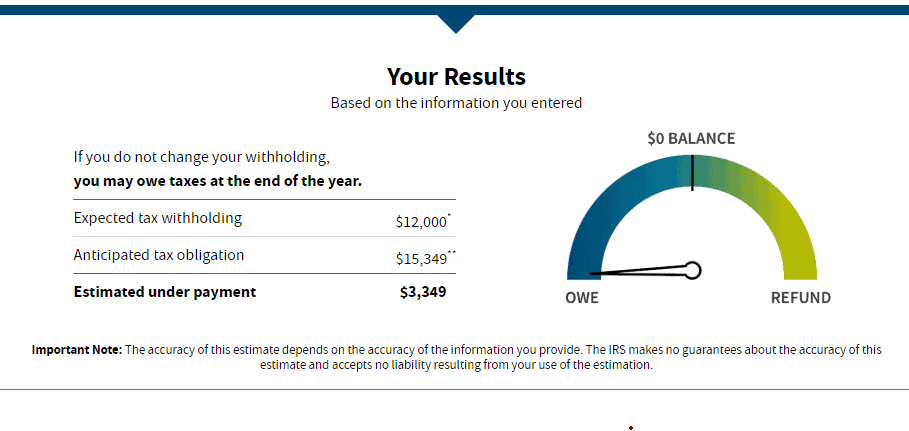

While the TWE will estimate your allowable tax credits, it does not incorporate that information into its calculation of your estimated overpayment or underpayment. To illustrate this point, we used the TWE for a taxpayer who we assumed earns $145,000 in wages ($12,000 in federal tax withholdings), $5,000 in investment income, claims the standard deduction and has two children under age 17. After inputting all of the information, this is what we saw:

The TWE estimates that the taxpayer’s total tax liability will be $15,349 and that $12,000 will be withheld from the taxpayer’s wages. Thus, it would appear that the taxpayer will have a $3,349 balance due when they file their taxes next April. However, if you keep scrolling down on that page, you will see that the taxpayer also is entitled to a $4,000 child tax credit. So, after applying that credit, the taxpayer is actually expected to get a refund of $651.

2. Overestimating Tax Liabilities

If you have investment income, the TWE assumes that all of your interest, dividends and capital gains are taxed at ordinary rates. Ordinary tax rates are often much higher than Qualified Dividend and Long Term Capital Gains rates, so be aware that the TWE might overestimate your tax liabilities.

3. Estimations relevancy due to Timing

Keep in mind that when the tool gives you suggestions for adjusting your Form W-4 to get your balance due/refund close to zero, its recommendations are relevant only for the remainder of the year. If you would like recommendations for a full tax year, you should complete the TWE again at the beginning of the next tax year.

In summary, the TWE can be very helpful for many taxpayers, but you should use with caution. If you have a more complex tax situation, the TWE will most likely prove to be inadequate. In this case we would recommend you contact your tax advisor for a more detailed tax analysis.

Questions on this topic? Contact your Keiter representative or Email | Call: 804.747.0000

About the Author

The information contained within this article is provided for informational purposes only and is current as of the date published. Online readers are advised not to act upon this information without seeking the service of a professional accountant, as this article is not a substitute for obtaining accounting, tax, or financial advice from a professional accountant.